how are property taxes calculated in orange county florida

Homeowners in Orange County pay a median annual property tax bill of 2073 annually in property taxes. If you do not have property in Martin County enter 0 in both the Market Value and Assessed Value fields.

Start Your Property Search With Www Orlandoareahomehub Com Find Homes For Sale Real Estate View Pictures Property Search Pinterest Logo Tech Company Logos

The Orange County Sales Tax is collected by the merchant on all qualifying sales made within Orange County.

. The Orange County Florida sales tax is 650 consisting of 600 Florida state sales tax and 050 Orange County local sales taxesThe local sales tax consists of a 050 county sales tax. One factor in determining Florida property taxes is just value which is simply the market value of a property. Ad Property Taxes Info.

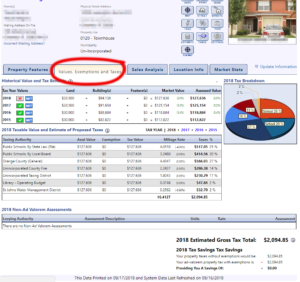

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Orange County. Taxes are calculated by multiplying the property value less exemptions by the millage rate which is. The TTC shall not be responsible or liable for any losses liabilities or damages resulting from an incorrect APN Property Address Purchase Price Purchase Date andor Exemption Type.

407 434-0312 Media Inquiries Only. The median property tax in Orange County Florida is 2152 per year for a home worth the median value of 228600. Real Estate Taxes in Florida and How They Are Calculated Palm Beach County and the Treasure Coast Property taxes throughout Florida and Palm Beach county and the Treasure Coast are based on millage rates which are used to calculate your ad valorem taxes.

Box 545100 Orlando FL 32854. Office of the Clerk of the Board. Box 545100 Orlando FL 32854 with payment made payable to Scott Randolph.

Post Office Box 38. The Treasurer-Tax Collectors Office TTC has not verified the accuracy of the APN or the property address keyed in. Orange County has one of the highest median property taxes in the United States and is ranked 386th of the 3143 counties in order of median property taxes.

A proposal that would increase homestead property-tax exemptions for teachers military members and first responders is ready to be considered by the Florida House. Sec-Twn-Rng-Sub-Blk-Lot dashes optional. 16th FL Orlando FL 32708.

The Property Appraisers Office also determines exemptions for Homestead Disability Widows Veterans and many others. Online Property Taxes Information At Your Fingertips. Floridas average real property tax rate is 098 which is slightly lower than the US.

Current property is no longer listed for sale on IndexPost and we are unable to track its current status. Orange County Tax Collector PO. Groceries are exempt from the Orange County and Florida state sales taxes.

Therefore you must add the school taxes back in to the Gross Tax amount approximately 20000. Florida real property tax rates are implemented in millage rates which is 110 of a percent. Orange County collects on average 094 of a propertys assessed fair market value as property tax.

The Property Appraiser determines the ownership mailing address legal description and value of property in Orange County. Detach and return the notice to Property Tax Department PO. Previous Property selling or sold To find your current market value or assessed value click here for details.

2031 Cornell Pl Port Orange Florida 32128 - MLS 1001845 - OFF MARKET This 2 beds 25 baths Single Family property located by address 2031 Cornell Pl Port Orange Florida 32128. This additional exemption does not apply to school taxes. Florida tax rates by county are determined by county appraisers.

Market and assessed values can be found on any Florida Countys Notice of Proposed Property Taxes. Market Value Assessed. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties.

The median property tax on a 22860000 house is 240030 in the United States. On January 29 2008 Florida voters approved an additional 25000 homestead exemption to be applied to the value between 50000 and 75000. Pay In Person Walk-ins are welcome at our Tax Department located at 200 S.

In Orlando Orange Countys largest city the millage rate varies from about 185 and up to more than 197 mills depending on where in the city you reside. Last Name First Name OR II. Just value considers the price a property will sell for given current market conditions in an arms length transaction.

The median property tax on a 22860000 house is 221742 in Florida. One mil equals 1 for every 1000 of taxable property. In Orange County higher sales prices are driving up property taxes Rates can differ widely even among neighbors for a variety of reasons To estimate their tax rate homeowners can use the.

Strickland S Landing In Jacksonville One Of The Most Fun Place I Went In My Childhood It S Closed Now S Jacksonville Florida Florida Travel Jacksonville Fla

Buying A Home Or Condo In Orlando Metro City Realty Buying First Home First Home Buyer Home Buying Process

Kentucky Rural Housing Usda Loans Usda Loan Conventional Loan Buying First Home

Stl News Return On Assets Business Funding Deferred Tax

Google Map Charlotte County Florida

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Home Buying Process Buying First Home Home Buying

Realtors Property Manager Keller Tarrant County Bedford Property Management Tarrant County Renting Out A Room